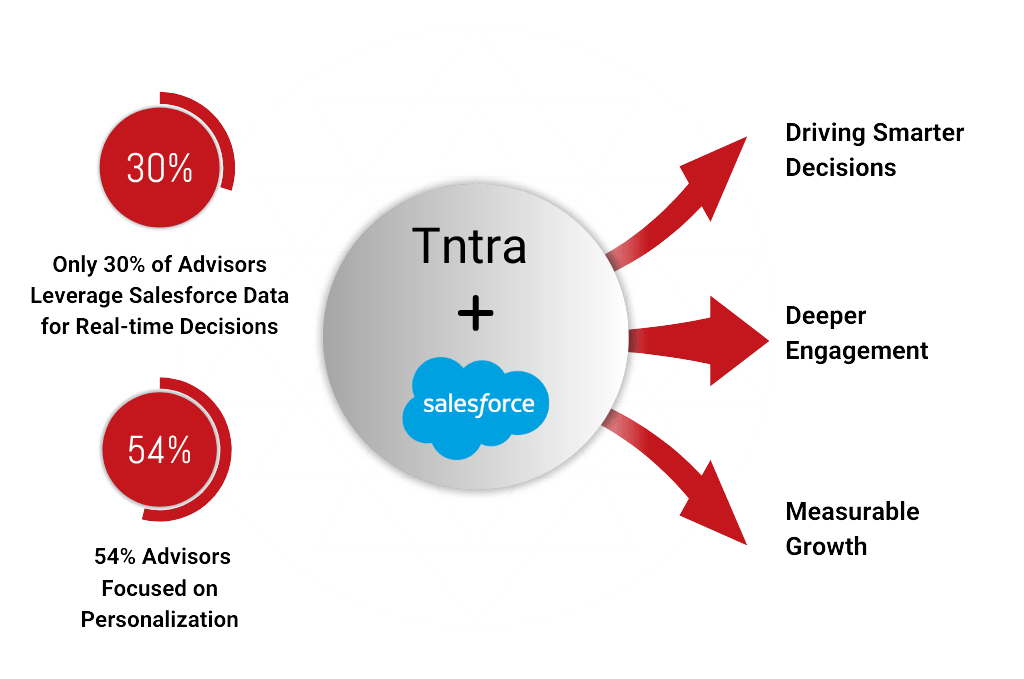

Maximize the Full Potential of Salesforce with Tntra

Only 30% of advisors use Salesforce data for real-time decisions, while 54% focus on personalization. Tntra helps financial institutions unlock the full potential of Salesforce, driving smarter decisions, deeper engagement, and measurable growth.

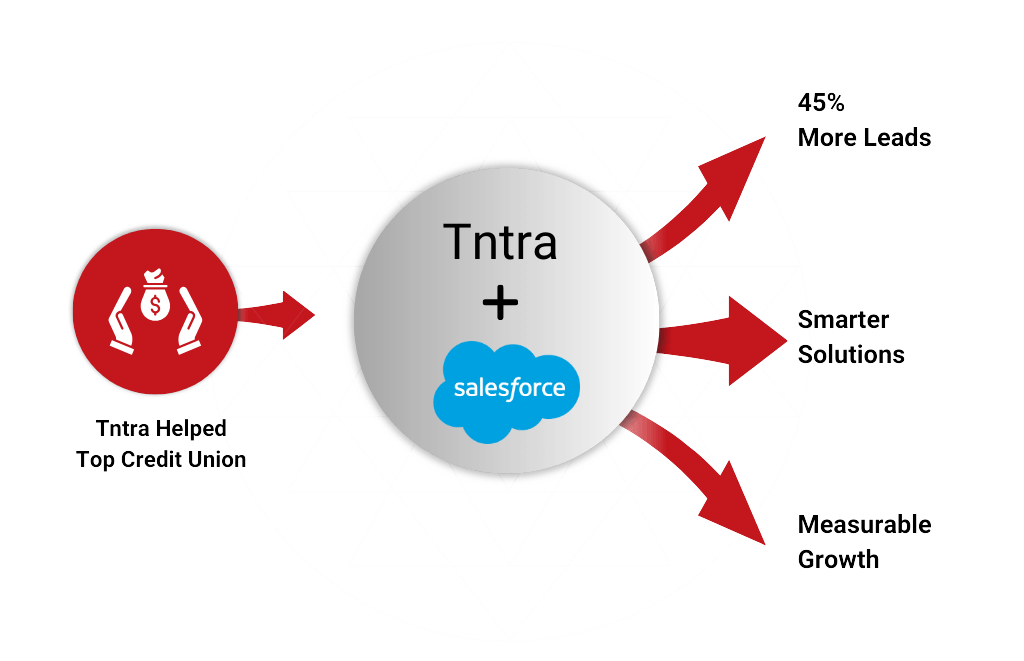

45% More Leads for a Leading Credit Union in the South

Tntra helped a top credit union to unlock growth by uncovering 45% more leads with Salesforce. Let us drive your business forward with smarter solutions and measurable results.

End-to-End Consulting Designed for Financial Institutions

At Tntra, we simplify the complexities of adopting Salesforce Financial Services Cloud (FSC). From initial implementation to ongoing FSC support, we ensure a seamless transition for your financial institution, enabling you to unlock the full potential of Financial Services Cloud.

How Tntra Empowers Financial Institutions

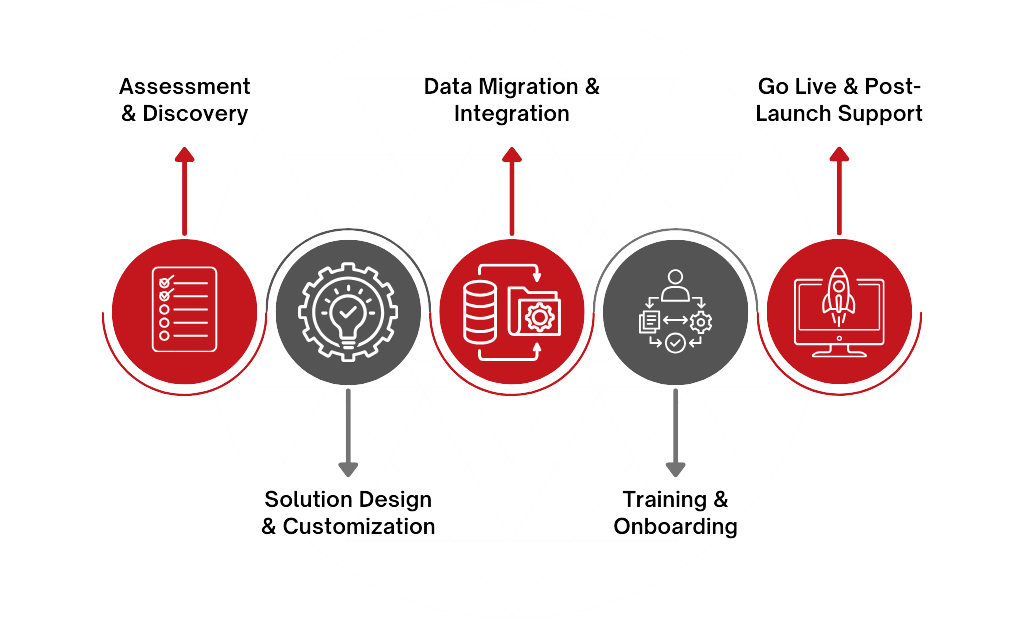

Transitioning to Salesforce Financial Services Cloud can be daunting, but Tntra ensures a smooth migration process:

- Data Mapping and Transfer: Securely migrate data from legacy systems without disruption.

- Compliance Assurance: Maintain regulatory integrity throughout the migration process.

Tntra tailors FSC to meet the specific needs of banks, credit unions, wealth management firms, and insurers:

- Customized Workflows: Build workflows aligned with your operations.

- Rapid Deployment: Leverage our expertise to get FSC up and running efficiently.

We connect FSC with your existing systems to create a unified financial ecosystem:

- Core Banking Integration: Achieve seamless communication between FSC and your core banking platforms.

- Omni-Channel Syncing: Synchronize data across digital and in-person customer touchpoints.

Adopting new technologies requires cultural alignment. Tntra supports you with:

- Training and Enablement: Equip your team with the skills to leverage FSC effectively.

- User-Centric Strategies: Focus on creating intuitive experiences to drive adoption.

Our partnership doesn’t end at implementation. Tntra offers continuous support:

- Proactive Monitoring: Ensure FSC operates at peak performance with minimal downtime.

- Regular Updates: Keep your platform aligned with Salesforce’s latest features and security standards.

- On-Demand Expertise: Gain access to a team of certified Salesforce specialists whenever needed.

- Streamlined Contract: One simple monthly agreement covers all your support, tools, and strategic consultation.

Tntra customizes FSC to meet the unique demands of financial service sectors:

- Banking and Credit Unions: Enhance client onboarding, reduce churn, and deepen customer relationships.

- Wealth Management: Optimize portfolio tracking, advisor productivity, and personalized client engagement.

- Insurance: Streamline claims processing, customer service, and compliance tracking.

Get Started with Tntra's Salesforce Financial Services Cloud Solutions

Transform your financial services today. Contact us for a free consultation on how we can streamline your Salesforce integration.

Benefits of Salesforce Financial Services Cloud Integration

for Banks & Credit Unions

Unlock the full potential of Salesforce Financial Services Cloud with a solution tailored for financial firms, including banks and credit unions. Salesforce FSC enhances client relationships, boosts operational efficiency, and ensures global compliance. By integrating Salesforce Financial Services Cloud, banks and credit unions can access real-time data, automate workflows, and personalize customer journeys using AI-driven insights.

This powerful solution offers a 360° view of clients, helping financial firms identify growth opportunities, improve customer experiences, and scale operations securely while maintaining the highest standards of data protection and compliance.

Salesforce Financial Services Cloud Implementation Steps

Implementing Salesforce Financial Services Cloud is a strategic process that ensures your organization maximizes the platform’s potential. Our approach focuses on ensuring a seamless transition, from initial assessment to post-launch support.

Success Stories

From AI-powered tools to Salesforce Financial Services Cloud, discover how these innovations have helped banks, credit unions, and financial firms boost productivity, improve client engagement, and achieve significant cost savings.

Tntra empowered a leading financial institution to strengthen customer relationships, improve employee productivity, and reduce servicing costs by implementing Salesforce's AI-powered tools, including Next Best Action (NBA), AI-driven analytics, and low-code automation. With features like a 360° customer view, workflow automation, and real-time access to data, the institution achieved remarkable results: a 27% increase in customer satisfaction, 24% growth in employee productivity, 26% reduction in operational costs, 28% rise in sales, and 29% boost in cross-selling opportunities.

Checkout Full Case StudyTntra enabled a leading credit union in the South to achieve a 45% increase in leads by maximizing the potential of Salesforce Financial Services Cloud. The credit union faced challenges with inefficient lead management, fragmented customer data, and underutilized CRM capabilities.

By unifying customer data, leveraging AI-driven lead prioritization, and automating workflows, Tntra transformed the credit union’s lead generation process. This led to higher conversion rates, enhanced engagement, streamlined operations, and measurable growth, highlighting the power of an optimized Salesforce Financial Services Cloud solution.

Checkout Full Case StudyTntra empowered a mid-sized insurance provider to enhance business agility by implementing Salesforce’s automation solutions. By automating data collection, document generation, and workflows, the provider achieved a 40% reduction in processing times, a 35% boost in employee productivity, a 30% increase in customer satisfaction, and a 25% reduction in operational costs. These advancements streamlined operations, improved service delivery, and enabled scalable growth.

Checkout Full Case StudyTntra transformed a regional bank’s loan and mortgage management processes by implementing Salesforce’s Financial Services Cloud and automation tools. By digitizing loan origination, centralizing application tracking, and integrating personalized customer engagement, the bank achieved a 45% faster loan processing time, a 40% improvement in customer satisfaction, a 35% boost in operational efficiency, and a 30% growth in loan applications, streamlining operations and enhancing customer trust.

Checkout Full Case StudyUnlock Your Financial Institution's Potential with Tntra

Ready to drive real results like our clients? Get in touch with our experts to explore how Tntra can transform your operations and boost your business performance with Salesforce FSC.

Book Your Solution Call!Why Tntra for Salesforce Financial Services Cloud Services?

Industry Expertise & Certifications

Specialization in financial services like banking, credit unions, wealth management, and insurance.

Proven experience in addressing industry-specific challenges and compliance requirements.

Accelerated & Risk-Free Deployment

Use of industry frameworks to ensure quick, smooth, and secure implementation.

Pre-built workflows and automation to reduce deployment risks.

Certifications & Customer Satisfaction

300+ Salesforce Certifications.

4.5/5 Customer Satisfaction Score.

Proven Results

25% reduction in operational costs through streamlined workflows.

99% uptime for critical financial systems.

Transform Your Business with Tntra

Let Tntra help you harness the full potential of Salesforce Financial Services Cloud Solution to transform your business. Contact us today to get started on redefining customer experiences and achieving operational excellence.

Start your Salesforce integration journey today and experience the Tntra difference.

Book Your Solution Call!Getting started is easy with Salesforce’s onboarding support, including training, implementation guides, and expert assistance.

Yes, FSC offers scalable solutions that grow with your business, making it ideal for SMBs seeking enterprise-grade capabilities.

Yes, Salesforce Financial Services Cloud Financial Services Cloud is designed to scale seamlessly with organizations of any size, adapting to both immediate needs and long-term growth. It supports scalability through flexible architecture, scalable data management, support for multi-division growth, expanding features and integrations, and future-proof technology.

By integrating Salesforce FSC, organizations can expect a strong ROI through a combination of revenue growth, cost savings, and improved client satisfaction. While ROI varies depending on the organization's scale and strategy, these benefits make FSC a worthwhile investment for long-term success.

Unlike traditional CRMs, Financial Services Cloud is industry-specific, offering tools tailored to financial services like compliance management, client insights, and seamless integrations.

- Improved client management and retention

- Enhanced operational efficiency with automation

- Scalable, secure, and compliance-ready solutions

- Increased revenue through personalized customer experiences

Financial Services Cloud provides a 360° customer view, personalized client interactions, and compliance-ready workflows, enabling financial institutions to build trust, improve efficiency, and drive growth.

Salesforce Financial Services Cloud is a customer relationship management(CRM) platform tailored for financial institutions. It unifies client data, enhances customer engagement, and streamlines operations for banks, wealth managers, and insurers.