Innovate, Transform, and Thrive in Finance with Tntra’s FinTech Practice

Tntra stands at the forefront of FinTech innovation, empowering businesses with strategic software product engineering and digital transformation tailored specifically for the financial sector.

FinTech Framework that Translates Challenges into Future Opportunities

At Tntra, we understand that every FinTech enterprise, from emerging startups to established giants, requires solutions that are both tactical and strategic.

Our expert team collaborates with you to define and deploy innovative solutions that address immediate business needs while laying the groundwork for sustainable growth.

Our unique, IP-driven FinTech framework not only helps businesses develop cutting-edge solutions but also connects them with a global network of mentors, domain experts, and partners.

FinTech Framework

Tntra’s FinTech Framework is designed to empower organizations with strategic insights and innovative solutions across three key pillars: Payment Expansion, Cashless Payments, and Risk Mitigation.

Expand Payments incorporates a wide range of digital payment solutions, from mobile wallets and contactless payments to peer-to-peer and cross-border transactions. By leveraging blockchain, cryptocurrency, and open banking, businesses can offer secure, efficient, and transparent payment options, enhancing user convenience and global accessibility.

Risk Mitigation enhances security and compliance through tokenization, fraud detection, and biometric authentication. AI-driven tools help automate regulatory processes and manage risks, while cybersecurity measures protect financial data and transactions, ensuring a safer financial environment.

Cashless Payments simplify financial transactions by offering digital banking, mobile wallets, and seamless payment processing. These systems provide secure, real-time payments and customer-focused services, making traditional cash transactions less necessary.

FinTech Solution Overview

Payment Expansion

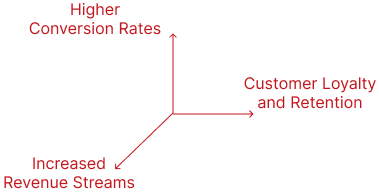

Increased Revenue Streams: Offering flexible payment methods like BNPL and enhanced gateways captures a broader market, driving higher sales as customers embrace alternative payment options. Higher Conversion Rates: Diverse payment choices such as digital wallets and BNPL reduce cart abandonment and attract global customers, boosting conversions and driving growth.

Risk Mitigation

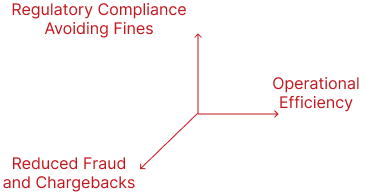

Reduced Fraud and Chargebacks: Secure tokenization and intelligent payment systems prevent fraud and minimize chargeback costs, ensuring safer transactions and protecting customer data. Regulatory Compliance: Adherence to security regulations helps avoid fines, safeguarding both operational efficiency and brand reputation.

Cashless Payments

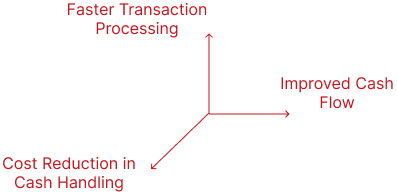

Cost Reduction in Cash Handling: Cashless transactions cut costs associated with physical cash processing, improving operational efficiency and security. Faster Transaction Processing: Digital payments enhance customer satisfaction with faster transactions, benefiting high-volume environments through increased throughput.

FinTech Framework – AI Approach

Tntra’s FinTech AI Approach revolutionizes payment systems and enhances operational efficiency through cutting-edge technology. This framework focuses on three core areas:

This pillar focuses on streamlining and enhancing payment systems through technology. AI-driven tools optimize payment gateways by offering real-time currency rate predictions and personalized transaction experiences. For example, in the banking sector, AI algorithms integrated into forex systems help predict currency fluctuations, ensuring smoother, more efficient international transactions. Similarly, AI analytics in mobile point-of-sale solutions provide merchants with real-time insights on payment trends, improving business operations.

The integration of AI into cybersecurity solutions enhances real-time threat detection and secure authentication processes. For instance, in cybersecurity, AI-driven algorithms are employed to detect potential fraud during multi-factor authentication processes, offering advanced security without compromising user experience. Additionally, AI is used in blockchain platforms such as Central Bank Digital Currency (CBDC) systems to analyze transaction patterns and identify anomalies, providing secure, personalized financial services

AI is revolutionizing loan origination and processing systems by enhancing efficiency and accuracy. In the case of consumer loan platforms, AI-based predictive analytics help optimize regression testing, reducing processing time from days to minutes. By integrating AI into planning and resource allocation, financial services can estimate project timelines more effectively, enhancing both customer experience and operational efficiency. AI also drives smarter loan systems, allowing companies to streamline complex operations and ensure compliance.

Our FinTech App Development Service

Tntra's specialized teams have been dedicated to serving emerging and established FinTech enterprises since the inception of this sector. Our goal is to provide businesses worldwide with IP-led FinTech software development services that cover the whole range of the FinTech ecosystem.

At Tntra, we offer comprehensive custom IP-led FinTech software development services tailored to empower financial sector businesses. Tntra's mission is to facilitate digital transformation and optimize the utilization of financial data. We collaborate with forward-looking financial institutions, ranging from established banks to innovative FinTech startups, to enhance the convenience and security of digital finance through our cutting-edge solutions.

Tntra pioneers the development of AI-powered financial management apps, empowering institutions with intelligent insights for better decision-making and heightened user involvement. In today's automation-driven landscape, AI proficiency is paramount. Financial entities increasingly integrate AI to streamline repetitive tasks, ensure seamless customer service, conduct in-depth behavioral analysis, and bolster fraud prevention within an innovative, cashless ecosystem.

Tntra's IP-Led software product engineering solution powers the creation of IoT applications for the financial industry. With the use of cutting-edge technology like intelligent payment systems, sophisticated data analytics platforms, and fraud detection sensors, we help FinTech businesses automate their processes. This improves the general consumer experience while also lowering breaches.

Tntra is a key player in advancing the cashless economy as an innovator in FinTech software development. We make it easy for websites and applications to integrate third-party payment gateways like PayPal or Stripe, guaranteeing safe and easy online transactions for users. We can provide quick, dependable, and secure payment processing for financial items by integrating these gateways with your current financial applications.

Tntra excels in developing custom FinTech software solutions, including proficiency in custom AIS software like Sage, SAP, and others. Our team has a great deal of experience integrating AIS modules with smart business intelligence tools and ERP systems. This expertise helps startups and large corporations maximize their financial performance.

Technology Stack

Portfolio Partners & Ecosystem - FinTech

W;nk delivers AI-powered identity and payments solutions, offering biometric-based authentication through facial and voice recognition to enable simpler, more secure commerce experiences.

TrustNoteD specializes in providing distributed ledger solutions for trusted data exchange across decentralized networks.

Strong Force specializes in intellectual property (IP) services, offering innovative tools and strategies to help companies protect and maximize the value of their IP assets.

Pulsar Security is a cybersecurity firm that focuses on ethical hacking, threat assessments, and providing top-tier security solutions for organizations.

DigiD is a blockchain-based identity management platform that offers secure and scalable solutions for digital identity verification.

Tntra believes that a good company builds and delivers marquee products and services.

But, a great company impacts the lives of all of its stakeholders for the better.

Blockchain-Based Central Bank Digital Currency

- Industry: FinTech Blockchain

- Location: Japan

National Banks worldwide face challenges in swiftly adopting digital fiat currencies due to the absence of standardized solutions.

Implementation of Salesforce Marketing Cloud for Financial Services

- Industry: Finance

- Location: USA

Targeted marketing initiatives are often hampered by fragmented consumer data in the finance industry. Departmental silos result in uneven messaging across media....

Loan Origination System Software Testing

- Industry: Finance

- Location: USA

In the landscape of consumer lending, a prominent player in the industry with over 70 years of legacy faced critical challenges in adapting to the...

Loan Management Platform

- Industry: Fintech

- Location: USA

The solution is an easy-to-use application developed for Loan Officers. It facilitates the sales process by allowing homebuyers to create on-demand (fully branded) pre-approval letters and loan calculations.

Real Estate Loan Inspection Platform

- Industry: FinTech

- Location: Singapore

The Inspection companies faced challenges handling numerous (high volume of) requests from banks for real estate inspections, resulting in a time-consuming and costly manual auditing process.

Blockchain-Based Digital Reward System

- Industry: FinTech Blockchain

- Location: Japan

A Japan-based conglomerate sought to enhance employee rewards by introducing digital money as loyalty points across diverse industries.

Digital Rewards Revolution: Harnessing NFTs to Redefine User Engagement

- Industry: Gaming (Genre - Trade)

- Location: Japan

Promoting user engagement and loyalty is a major problem for businesses looking to make a name for themselves in the quickly changing online...

Tntra helps fuel the FinTech solution adoption by incorporating Blockchain technology in our FinTech app development services for the financial services industry. Our FinTech Blockchain solutions, which handle high transaction volumes quickly and without middlemen to give direct access to financial services, indicate a new era of security and autonomy with DeFi solutions. Tntra's expertise in Blockchain technology ensures real-time data tracking and builds a thorough audit trail to increase accountability and transparency.