Risk Mitigation Through Multi-Factor Authentication

- Industry: FinTech

- Location: USA

Introduction

A global financial services corporation wanted to upgrade its authentication platform to stay in line with changing security protocols and offer secure, frictionless transactions. The corporation needed an advanced security system that would not only reduce the risk of fraud but also maximize user experience via smooth authentication methods. To achieve this, the client sought effective risk mitigation practices to safeguard against fraud while maintaining compliance with security standards.

- EMV 3DS 2.3

- PCI & FIDO Compliance

- Microservices Architecture

- AI-powered Fraud Detection

- Cybersecurity Measures

Business Problem

The client's legacy authentication infrastructure was based on a monolithic architecture, which was challenging to transform into new regulatory demands and security standards. This legacy infrastructure exposed the client to fraud attempts and could not support emerging authentication technologies like biometric security and behavioral analytics. To address these challenges, the client required a solution that incorporated advanced risk mitigation services and was compliant with EMV 3DS, PCI, and FIDO standards while providing a frictionless user experience.

Our Solution

Tntra implemented a robust authentication system customized to the client's requirements:

- EMV 3DS 2.3 Implementation: Developed and integrated a 3DS 2.3 authentication solution, providing secure transactions on all digital payment channels, thus enhancing risk mitigation practices against fraud.

- Microservices-Based Migration: Migrated the client's authentication system from monolithic to microservices architecture, improving scalability and system robustness while supporting enhanced risk mitigation services.

- AI-Powered Fraud Detection: Utilized machine learning algorithms to identify and block fraudulent transactions in real-time, an essential component of the client's risk mitigation practices.

- Regulatory Compliance: Guaranteed the new system met PCI and FIDO requirements, securing customer information and minimizing security threats, which are key to effective risk mitigation services.

- Seamless User Experience: Streamlined authentication processes to offer seamless, multi-factor authentication with no sacrifice in security, ensuring risk is mitigated without impacting usability.

Outcomes

With Tntra’s solution, the bank achieved:

- 50% decrease in authentication processing time: The use of microservices increased response rates, enabling transactions to be authenticated quickly while maintaining strong risk mitigation practices.

- Improved fraud prevention with AI-enabled risk detection: AI-driven fraud detection system actively detected and rejected malicious activity, a crucial aspect of risk mitigation services.

- Higher uptake by merchants and payment processors: The simplified authentication process fostered greater uptake among businesses and financial institutions, reflecting confidence in enhanced risk mitigation practices.

Conclusion

By implementing AI-based security features and adopting a microservices architecture, Tntra helped the client enhance its authentication infrastructure, increase transaction security, and meet industry regulations. The advanced solution improved fraud detection features greatly while ensuring an intuitive authentication process for users. The integration of strategic risk mitigation practices and comprehensive risk mitigation services significantly reduced the threat of fraud, reinforcing the client’s position as a secure and reliable financial services provider.

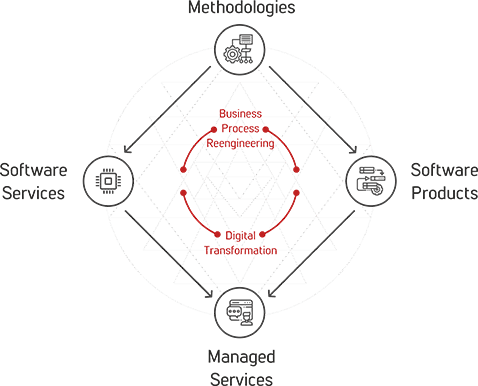

Tntra Diamond

Tntra's Diamond is a comprehensive approach to helping enterprises manage the constant interplay between Business Process Reengineering and Digital Transformation. Tntra’s domain specific methodologies lead to software services for mature systems and software product engineering for new requirements, further transitioning to a managed service model to ensure stability and scale.

Tntra's Diamond enables the enterprise to stay ahead of the transformation curve, while at the same time ensuring optimal business processes to meet the needs of the new economy.