Payment Expansion for Banking Services

- Industry: FinTech

- Location: USA

Introduction

A top multinational banking services company was looking to leverage its payment gateway functionality for convenient bulk payments with multiple providers in emerging and developed economies. The bank was plagued by inefficiency from an aged Java-based solution that could not process high transaction volumes and lacked integration with advanced forex exchange functionalities. The customer needed a reliable solution that could facilitate cross-border transactions while ensuring security and meeting financial regulations compliance.

- Kotlin

- API Integration

- Forex Currency Exchange System

- Secure Payment Gateway

- Compliance and Security Protocols

Business Problem

The current system of the bank created serious issues in processing large numbers of transactions through various financial institutions. Bulk payment processing was time-consuming, error-prone, and expensive due to inefficient business processes. The lack of an efficient Forex currency exchange process also hindered users from performing transactions in various currencies effectively. The absence of integration with new banking partners also limited the scalability of the bank's operations globally. The client required a scalable, secure, and efficient platform to combat these issues.

Our Solution

Tntra undertook a thorough analysis of the client's current infrastructure and recognized the pain areas that needed to be fixed. The team followed a multi-phased solution:

- Technology Upgrade: Transitioned the payment gateway from Java to Kotlin for the purpose of system performance improvement, security enhancement, and scalability.

- Banking Integrations: Added three new banks to the platform, supporting instant interbank transfers.

- Forex Exchange System: Implemented and integrated a Forex currency exchange system with real-time multi-currency support and low conversion latency.

- Unified API for Bulk Payments: Implemented a secure and efficient API framework that handled high-volume transactions between various financial institutions in an efficient and secure way.

- Regulatory Compliance & Security: Ensured compliance with international financial regulations, including better encryption protocols to secure transactions.

Outcomes

With Tntra’s solution, the bank achieved.

- 40% reduction in transaction processing time: The streamlined payment gateway significantly reduced processing delays, allowing bulk payments to be executed faster.

- Three new banking integrations within the first quarter: The enhanced platform successfully onboarded multiple banks, expanding the client’s reach and improving interoperability.

- Improved scalability and operational efficiency: The migration to Kotlin and the integration of a Forex exchange system allowed the client to scale operations efficiently and reduce dependency on manual transaction processing.

Conclusion

Through the modernization of the bank's payment gateway infrastructure, Tntra provided a solution that maximized transaction processing, increased banking partnerships, and enhanced customer experience. The Kotlin migration, along with API-driven improvements, enabled the client to simplify cross-border transactions, enhance operational efficiency, and create a competitive advantage in the financial services sector.

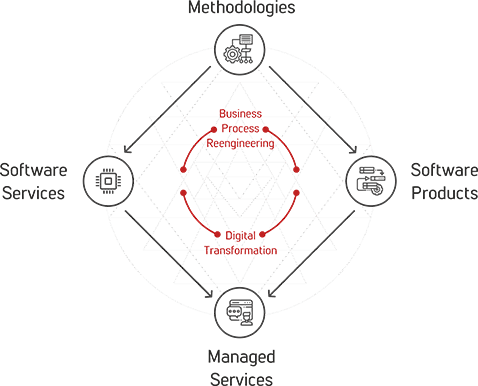

Tntra Diamond

Tntra's Diamond is a comprehensive approach to helping enterprises manage the constant interplay between Business Process Reengineering and Digital Transformation. Tntra’s domain specific methodologies lead to software services for mature systems and software product engineering for new requirements, further transitioning to a managed service model to ensure stability and scale.

Tntra's Diamond enables the enterprise to stay ahead of the transformation curve, while at the same time ensuring optimal business processes to meet the needs of the new economy.