Loan and Mortgage Management with Salesforce FSC

- Industry: FinTech

- Location: USA

Introduction

A regional bank sought to streamline its loan origination and mortgage management processes to increase efficiency and enhance customer engagement at every stage of the loan lifecycle. To address these needs, the bank explored Salesforce Financial Services Cloud for Mortgage Lenders, a robust platform tailored to optimize loan and mortgage workflows. However, the bank faced several challenges that led to delayed approvals, higher operational costs, and a suboptimal customer experience. By adopting FSC for Loan and Mortgage Management, the institution aimed to eliminate bottlenecks, reduce errors, and create a smoother, more efficient process for both employees and clients. The implementation of the best FSC for loan and mortgage management promised to transform their operations and elevate customer satisfaction.

- Tntra utilized Salesforce’s Financial Services Cloud and automation tools to streamline and digitize the loan and mortgage workflows.

Business Problem

The bank faced significant challenges in tracking loan applications, managing customer interactions, and ensuring timely communication. The lack of automation and reliance on manual processes resulted in delays, errors, and a suboptimal customer experience. To address these inefficiencies, the bank needed a solution like FSC Mortgage, which offers a centralized platform for loan management. With the support of Salesforce Consulting Service for Loan Management, the bank aimed to implement cloud-based financial solutions and utilize the best mortgage CRM software for lenders to streamline operations and enhance customer satisfaction.

Our Solution

Tntra implemented a tailored solution with key features, including:

- Loan Origination Automation: Digitized the application and approval processes to reduce delays and manual errors.

- Centralized Tracking:Created a unified dashboard for real-time tracking of loan and mortgage applications.

- Customer Engagement Tools: Integrated automated notifications and personalized communication throughout the loan lifecycle.

Outcomes

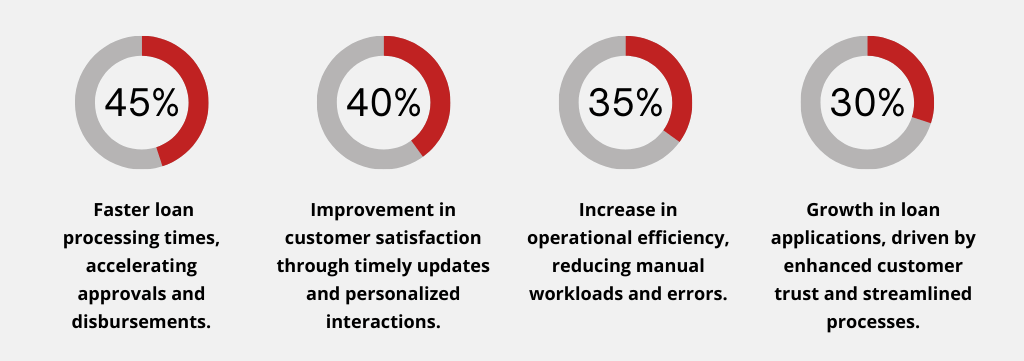

With Tntra’s solution, the bank achieved.

This solution highlights the importance of adopting the best FSC for loan and mortgage management to address gaps in loan and mortgage processes. Many financial institutions face challenges such as slow processing times, manual errors, and disjointed customer experiences, leading to customer dissatisfaction and operational inefficiencies. By leveraging FSC for Loan and Mortgage Management and implementing Salesforce Financial Services Cloud Mortgage, institutions can adopt automated workflows in Salesforce Financial Services Cloud Mortgage to streamline operations, reduce bottlenecks, and improve decision-making speed. These advancements enable a more personalized experience for clients, enhancing internal efficiency and fostering stronger customer relationships. Modernizing processes with Financial Services Cloud (FSC) helps institutions drive growth and stay competitive in an increasingly digital financial landscape.

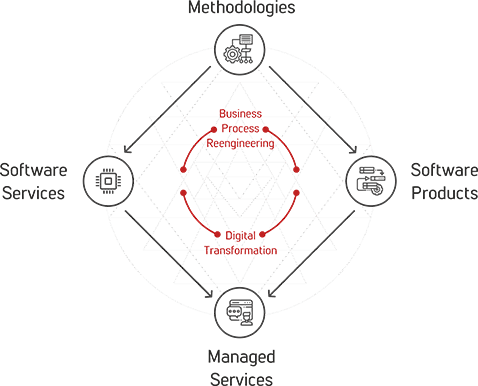

Tntra Diamond

Tntra's Diamond is a comprehensive approach to helping enterprises manage the constant interplay between Business Process Reengineering and Digital Transformation. Tntra’s domain specific methodologies lead to software services for mature systems and software product engineering for new requirements, further transitioning to a managed service model to ensure stability and scale.

Tntra's Diamond enables the enterprise to stay ahead of the transformation curve, while at the same time ensuring optimal business processes to meet the needs of the new economy.