Revolutionizing Central Bank Digital Currency: Tntra's Blockchain-Powered Solution Transforming Financial Landscapes with Speed, Security, and Scalability

- Industry: FinTech Blockchain

- Location: Japan

Introduction

National Banks worldwide face challenges in swiftly adopting digital fiat currencies due to the absence of standardized solutions. Traditional methods lack the agility and privacy required for modern digital transactions. Additionally, integrating new systems with existing infrastructure poses significant hurdles.

Amidst this backdrop, a pressing need arises for a comprehensive solution that not only adheres to Central Bank and Blockchain Association standards but also ensures seamless integration with existing systems. Furthermore, transaction privacy and scalability are paramount, necessitating a robust framework that can accommodate high transaction volumes while maintaining confidentiality.

Our Reference Implementation (RI) offers a transformative solution. Leveraging cutting-edge technologies such as Blockchain, Hyperledger Besu, and a meticulously crafted tech stack, our RI empowers National Banks to expedite digital currency issuance while upholding transaction privacy and scalability. With a project duration of just 28 days and a team size of 7 members, Tntra developed an architecture that promises effortless integration and minimal customization, ensuring a swift transition to the era of digital fiat currencies.

- Hyperledger Besu

- Java

- NodeJS

- EtherJS

- Web3

- React

- Solidity

- Docker

- Postgres

- AWS

- Wallet Management

- Digital Money

- Blockchain Network

- Agile (Kanban Framework)

- Microservices

- Extreme Programming (XP)

Business Problem

- National Banks face the challenge of efficiently transitioning from physical to digital currency systems while ensuring regulatory compliance and system integrity.

- Ensuring transaction privacy and confidentiality is crucial for maintaining trust and compliance within the financial ecosystem. However, existing systems mostly lack the necessary mechanisms to safeguard sensitive transaction data.

- Integrating new digital currency systems with existing banking infrastructure can be complex and challenging. National Banks need a solution that seamlessly integrates with their current systems, minimizing disruption and operational overhead.

Project Goal

- Provide a streamlined solution for national banks to issue and manage digital fiat currencies, reducing time to market.

- Develop a framework that adheres to standards defined by central banks and Blockchain associations, ensuring legal and regulatory compliance.

- Prioritize privacy and confidentiality while enabling scalability to handle a large volume of transactions, fostering trust and efficiency in digital currency transactions.

Solution Principles:

The solution is based on the following principles:

- The solution should be based on standards defined by the central banks and Blockchain associations.

- There should be an ease of integration with the central banks' existing systems.

- Transaction privacy and confidentiality with the ability to share information with the regulators.

- The solution should be scalable and should be able to handle a large number of transactions.

Solution Highlights:

- Leverage the Blockchain technology, specifically Hyperledger Besu, to provide a secure and transparent platform for digital currency issuance and management.

- Utilize Solidity for smart contract development, enabling automated and tamper-resistant execution of digital currency transactions.

- Implement a modular architecture using Java and Spring Boot microservices, facilitating flexibility, scalability, and maintainability of the solution.

- Offer intuitive user interfaces developed with technologies like React, NodeJS, and EtherJS, enhancing user experience and accessibility for both citizens and banking personnel.

Business Impact

- Mint and Burn Digital Currency: The central bank can mint and burn digital currency.

- Issue Digital Currency: The central bank can issue digital currency to the citizens.

- Payments using Digital Currency: The citizens can make payments to the merchants using digital currency.

- Bank to Wallet Transfer: The citizens can transfer the digital currency from their bank accounts to their digital wallet.

Features

Look at the top features our developers incorporated into the solution.

Solution for Modern Digital Currency Needs

The solution not only meets the requirements of new-age digital currency (Tokenomics) but also addresses the specific needs of central banks, ensuring a robust and adaptable framework for digital currency issuance and management.

Efficient Implementation with Minimal Customization

The architecture is designed for easy utilization by national banks. Its modular and customizable design minimizes the need for extensive customization, streamlining the implementation process and reducing time to market for digital currency adoption.

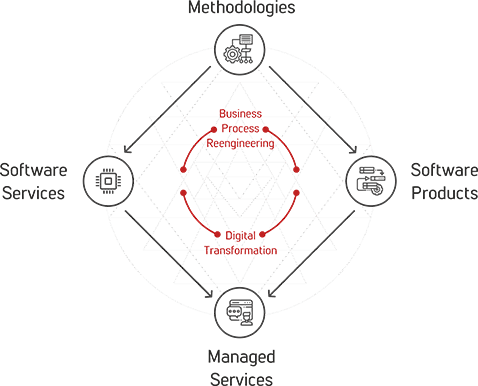

Tntra Diamond

Tntra's Diamond is a comprehensive approach to helping enterprises manage the constant interplay between Business Process Reengineering and Digital Transformation. Tntra’s domain specific methodologies lead to software services for mature systems and software product engineering for new requirements, further transitioning to a managed service model to ensure stability and scale.

Tntra's Diamond enables the enterprise to stay ahead of the transformation curve, while at the same time ensuring optimal business processes to meet the needs of the new economy.