Revolutionizing Salesforce Financial Services: How Custom FinTech Solutions Drive Innovation

Table of Contents

ToggleCustom FinTech solutions are revolutionizing financial services by enhancing operational efficiency, improving customer experiences, and driving FinTech innovation. Tailored solutions allow financial institutions to create scalable, secure platforms that meet the diverse needs of their clients. Platforms like the Salesforce Financial Services Cloud Solution exemplify how technology can be leveraged to improve data management, workflow automation, and client engagement, marking the future of financial services. Continue reading to learn more.

The trend towards revolutionary changes in financial service institutions was triggered by the acceleration of the most impactful fintech solutions. In the modern usage of the term, technology is no longer just an enabler but is now more core to the businesses and how it operates, and the services offered to customers: its core to data management.

With the unveiling of new and more powerful solutions by fintech companies on an ongoing basis, there is an emerging necessity in the ability to integrate financial services into every aspect of consumers’ lives. Based on this fact, customized FinTech solutions form a core part of the new efficiencies, improved user experience, and unlock previously untapped opportunities for both the financial institutions and the consumer.

The Role of Custom FinTech Solutions

The fintech solutions that are custom-made in order to meet specific business needs are game-changers in the financial services industry. This is because it enhances everything from customer service to data management at the back end with tailored fintech app development solutions, making it more streamlined and efficient. An example of a platform made for this purpose is salesforce financial services cloud Solution. The Salesforce FSC Platform helps financial services organizations build better relationshiss with their clients, manage workflows, and automate processes to enhance data security and regulatory compliance.

The customization of these solutions goes well beyond what off-the-shelf software can offer, imbuing the company with custom abilities that standard platforms simply can’t match. A software product engineering company focusing on Fintech app development services designs and creates a system that is not only more efficient but scalable, secure, and flexible to adapt to future changes within the Fintech ecosystem.

FinTech in Banking: A Case Study

The fintech ecosystem is fast-moving, and banks are no exception to this rule. Banks are looking at fintech application development services to build tailored applications addressing their unique needs, from digital payment solutions to loan management systems. Integration of FinTech in banking has empowered financial institutions to offer a wide range of services with more agility and improved customer experiences.

For instance, a fintech app development company can develop mobile banking application software that brings together diverse services, such as account management, payment, and financial planning, under one interface. Such apps not only ease banking processes but also enable users to make real-time decisions, monitor spending, and even invest from their hand-held devices. With more financial institutions adopting these Fintech app development solutions, the industry is bracing itself for even further transformation.

The Push for Fintech Adoption

Fintech innovation is among those great driving forces behind the current shift in financial services. The increasingly tech-savvy consumers demand seamless, instant access to their financial information and services. That is why fintech adoption is speeding up globally, as banks and other financial institutions recognize this need.

The challenge lies in choosing the right custom FinTech solutions; a one-size-fits-all approach often doesn’t meet the complex needs of different businesses or customer segments. Instead, companies need to partner with a software product engineering solution provider that is able to understand their requirements and create tailored applications that address their specific goals. The result is a highly adaptable financial ecosystem wherein everything, from payments to wealth management, can be done in a much more efficient manner.

Embracing Digital Payments and Blockchain

Digital payment solutions are venturing into the domain of services, anticipated especially in global trade and e-commerce. With such advances in FinTech innovation, both businesses and consumers are finding most of peer-to-peer payments, digital wallets, and cryptocurrencies quite good alternatives to traditional banking. The game-changing effect has been felt in both personal and business finance because of instant and secure money transfers, mostly without the mediation of a bank.

Similarly, blockchain technology represents one more area of innovation in FinTech that will change the face of financial services. On a larger scale, blockchain offers an unbeatable level of transparency, security, and effectiveness on a global scale—but, at the same time, it is disrupting almost everything from payment systems down to supply chain financing. Increasingly, fintech firms are looking at possibilities for integrating blockchain with established structures, pushing the limit of what’s possible.

Custom FinTech Solutions Benefits

Businesses across industries are capitalizing on the ability to tailor applications to their unique needs. Some of the most vital benefits include:

- Better Customer Experience: The level of personalization in features offered by custom solutions can also be highly specific to the preferences of each individual user, hence improving customer satisfaction.

- Scalability: As financial institutions grow, the custom-built solution is able to scale without the restrictions frequently associated with off-the-shelf software.

- Regulatory Compliance: Custom-built solutions are designed with industry regulations in mind, so businesses can be assured that they will remain compliant while putting leading-edge technologies into operation.

- Operational Efficiency: Tailored software can automate routine tasks and processes, reducing human error and freeing up time for more critical business functions.

It’s through FinTech software development services that businesses can develop solutions for exactly these needs and lead to the next wave in FinTech innovation, revealing new dimensions of growth and transformation.

Conclusion: FinTech Solutions Drive Innovation

Innovative FinTech solutions have not only transformed how we handle finances, but further have instilled a far more integrated, efficient, and consumer-focused financing world. Salesforce financial services cloud solutions have helped organizations become more efficient in customer data management, process efficiency, and development of new innovative financial offerings.

Bespoke FinTech solutions can, therefore, bring a competitive advantage in the form of functionalities unavailable in off-the-shelf products. The ability to tailor solutions according to business needs encourages innovation within organizations by driving them to experiment with new business models, products, and services.

With the evolution of the fintech environment, it is inevitable that custom solutions shall continue being in the forefront of such revolutionary progress.

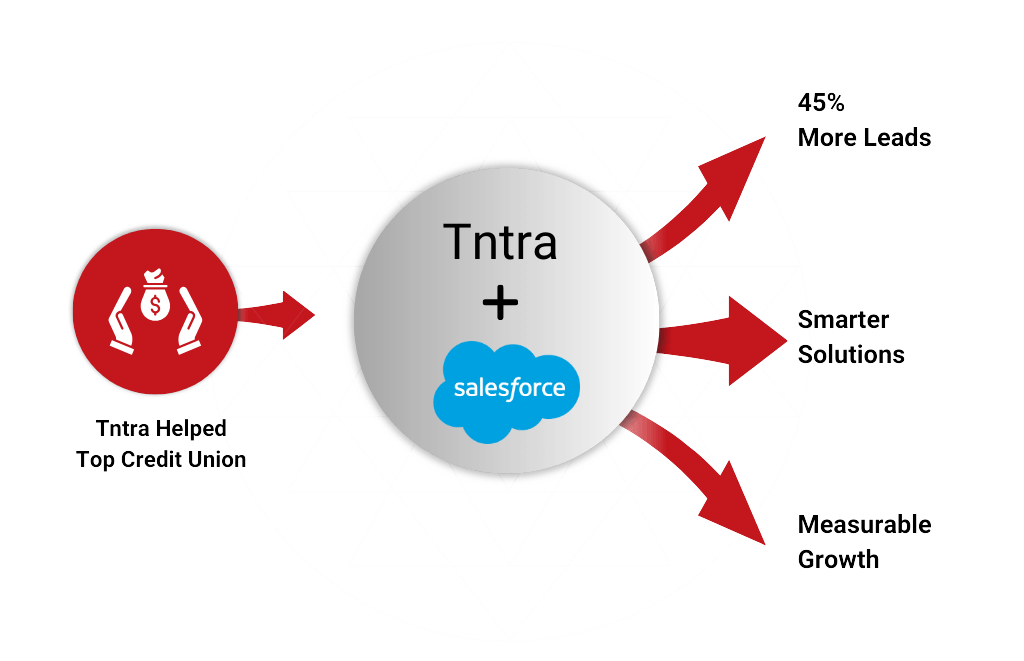

Tntra combines the best in technology, financial know-how, and creativity and brings a new dawn in financial services: nimbler, responsive, and customer-centric than anything that it has ever been before.

Contact us today for customized fintech solutions!

How do Custom Fintech Solutions Revolutionize Financial Services?

Custom FinTech can help with tailored digital payment solutions that optimize financial transactions and enhance customer service experience. Such solutions often drive the businesses’ digital transformation efforts because they are scalable and efficient in the ever-evolving industry as they leverage the likes of Salesforce Financial Services Cloud (FSC) solution.

Why are Custom Fintech Tools Critical for Innovation?

Custom FinTech tools provide immediate and quick access to the required functionality by financial services companies and enable flexibility in being competitive. Such capabilities further ensure that an institution is digitized in delivering its innovative solutions such as digital payment systems and personalized offerings.

What Trends are Shaping Fintech in 2025?

In 2025, major trends would include AI-powered analytics, blockchain for secure transactions, and the increasing popularity of digital payment solutions. Furthermore, it will feature more Salesforce Financial Services Cloud (FSC) – enhanced customer experiences resulting from more advanced FinTech platforms for better-informed decisions and innovations in financial services.

How do Fintech Solutions Drive Financial Service Growth?

Custom-built software for financial services that create operational efficiencies, infuse customer engagement, and offer high-trend digital payments. With Salesforce Financial Services Cloud (FSC) integration, businesses can create opportunities for new avenues of growth and drive innovations in financial services.