The Role of Technology Consulting in FinTech Innovation

Table of Contents

ToggleTechnology consulting firms are at the forefront of the FinTech revolution, employing AI, ML, and Blockchain to drive innovation. They strategically align technology with business objectives, ensuring sustainable growth. By guiding in the selection of scalable technology stacks, they pave the way for long-term success. Additionally, user-centric design is prioritized, enhancing overall customer satisfaction. Embrace the FinTech revolution and elevate your financial services with the expertise of fintech consulting firms, promising secure, efficient, and customer-centric solutions.

In the UK, the FinTech landscape is thriving, boasting over 1,600 firms employing a workforce of 76,500. These dynamic companies are revolutionizing conventional banking practices through cutting-edge innovations, driving rapid sectoral expansion.

Barclays has long recognized the pivotal role of collaborating with financial services startups, particularly those aligned with the bank’s expertise. Barclays has identified and supported promising startups through strategic investments and partnerships, reaping mutual benefits. Noteworthy collaborations include ventures with FinTech players like Flux, a digital receipt company, and Market Finance, a financial solutions and invoice firm. These alliances not only helped grow the startups but also infused Barclays with novel technologies and services.

Engaging with FinTech firms injects a breath of fresh ideas into Barclays’ operational framework. It harmonizes with the bank’s internal focus on advancing FinTech software development and investing in technology to enhance its offerings. Moreover, it addresses prevalent challenges within the broader industry. Acknowledging that they don’t possess all the answers, Barclays values FinTech startups for their potential to offer innovative perspectives and solutions for existing and future hurdles.

The collaboration not only elevates the technological landscape but also fosters an environment of continuous learning and innovation, positioning Barclays at the forefront of the evolving financial services industry. Through strategic investment and through the help of fintech consulting services, Barclays continues to pioneer FinTech advancements, ultimately benefiting the bank and its partnered startups.

Source: Barclays

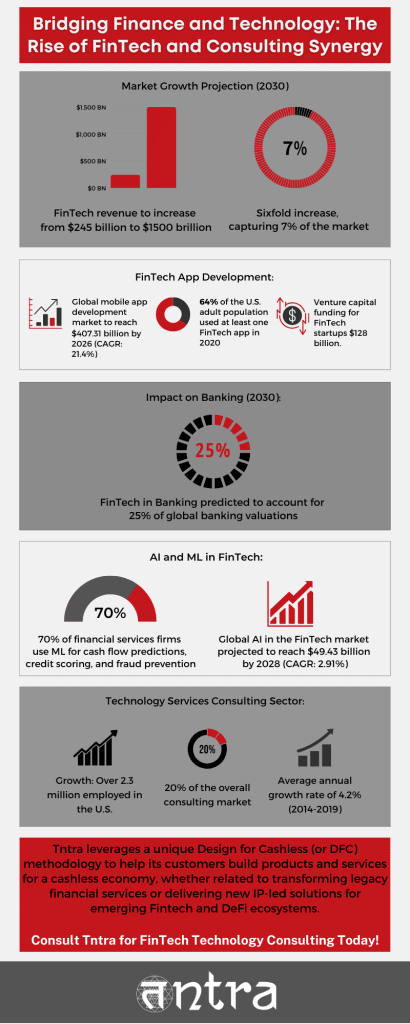

The Transformative Power of FinTech Innovations

The financial industry will see a seismic shift because of the FinTech revolution. According to a recent Boston Consulting Group (BCG) and QED Investors analysis, financial technology revenue is expected to climb from $245 billion to an amazing $1.5 trillion by 2030, a spectacular sixfold increase. A 2% portion of the $12.5 trillion in annual worldwide financial services revenue is currently controlled by the FinTech industry. However, this is expected to change dramatically since the FinTech sector is predicted to hold up to 7% of the market. Notably, banking FinTechs are predicted to play a crucial role; by 2030, they may account for about 25% of all banking valuations globally.

The technology services consulting sector, including IT and technology consulting, has experienced substantial growth, employing over 2.3 million people in the United States alone. This field accounts for roughly 20% of the overall consulting market and demonstrated an average annual growth rate of 4.2% between 2014 and 2019. Furthermore, the assistance of a FinTech app development company is poised to impact this dynamic industry landscape significantly.

A software product engineering company like Tntra holds the expertise to empower FinTech enterprises by leveraging the immense potential of Artificial Intelligence (AI) and Machine Learning (ML). Recent findings from Deloitte Insights indicate that 70% of financial services firms utilize ML to enhance cash flow predictions, refine credit scoring, and combat fraud. Moreover, the Economist Intelligence Unit’s research highlights that 54% of Financial Services organizations with 5,000+ employees have embraced AI. With the global AI in FinTech market projected to reach $49.43 billion by 2028, at a steady CAGR of 2.91% (2023-2028), Tntra is poised to play a pivotal role in engineering top-tier FinTech applications.

A specialized FinTech app development solutions company holds the expertise to assist financial sector enterprises in crafting top-tier applications. With the global mobile app development services market projected to surge from USD 106.27 billion in 2020 to USD 407.31 billion by 2026 at an impressive CAGR of 21.4%, the demand for innovative FinTech solutions is evidently on the rise. In 2020, a significant 64% of the US adult population utilized at least one FinTech app, highlighting the widespread adoption. Moreover, with venture capital funding for FinTech startups reaching a staggering $128 billion, the potential for groundbreaking applications in this sector is substantial. Across the globe, a noteworthy 77% of individuals now rely on their mobile phones for payments, underscoring the pivotal role of mobile technology in financial services. Among Gen X, more than 90% express enthusiasm towards mobile banking and fintech apps.

FinTech app development services play a pivotal role in driving the digitization agenda for financial sector companies. They leverage cutting-edge technologies like AI, ML, blockchain, and data analytics to revolutionize financial services. With a proven track record of successful implementation, these firms empower FinTech enterprises to enhance efficiency, security, and customer experience. As the FinTech revolution continues to reshape the industry, the expertise of technology consulting company becomes indispensable in navigating and capitalizing on this transformative journey towards a digitally-driven financial landscape.

The Perfect Match: Why Banks and FinTech Startups Go Together

The world of finance is moving quickly, and you’ll need to catch up. All thanks to a collaboration between traditional banks and radical FinTech startups. Banks have the customers, trust, and experience—and startups bring the brilliant ideas and newest technology banks desperately need to keep up. When this collision of these two worlds takes place, amazing things unfold.

Take Barclays, for example. Barclays partnered with several FinTech startups to develop next-gen financial solutions via its Rise platform. For example, in India, in partnership with the government, a state-owned bank is issuing a centralized digital currency to facilitate transactions and promote a cashless economy. The best part? Banks gain access to this innovative movement through easier integration—creating a win-win for everyone involved: Startups gain access to a massive client base, and banks remain competitive on a technological front.

But here’s the thing: Banks and startups often don’t speak the same language. Banks are steeped in decades of history and exist within complex systems, while startups move at blistering speeds with bright, disruptive ideas. That’s where Technology consulting in FinTech plays a crucial role—helping iron out the kinks and ensuring both sides can communicate in the same language. FinTech innovation through technology consulting enables these collaborations to thrive by streamlining integration and accelerating growth. Consulting firms serve as the bridge between the old and the new world, ensuring seamless cooperation.

What Sets FinTech Consulting Apart

Here’s where things get interesting. In the FinTech world, time is everything. If it takes too long for a new idea to enter the market, it might already be stale. The role of IT consulting in financial technology is to navigate these waters by shortening development cycles and eliminating distractions—delivering what’s critical to iterate and bring to market. Consulting firms help businesses skip the “trial-and-error” phase in technology implementation, thus saving time and money.

Not to mention user experience. If your app is not smooth and user-friendly, customers will leave in today’s world. Digital transformation in FinTech consulting ensures that apps are not only functional but also intuitive, driving customer retention.

Numbers speak volumes here. The last few years have witnessed an explosion in mobile payments, driven by FinTech apps. Companies that leverage FinTech consulting services for startups experience higher ROI and gain a larger share of the market. That’s where consultants come in—they ensure businesses implement FinTech strategies that deliver real results, not just flashy concepts.

What’s Next for FinTech?

We will sneak into the FinTech Future because that is all about three big trends.

- Sustainability and Green Finance

ESG (Environmental, Social, Governance) goals are no longer just buzzwords—they’re a necessity. Consumers and investors are prioritizing sustainability. Digital consulting solutions for FinTech companies help financial institutions align their strategies with sustainability goals and implement the right technology to drive green finance initiatives.

- RegTech and Compliance

Financial regulations are constantly evolving, making compliance a full-time challenge. Enter RegTech—technology designed to automate the compliance process. Best technology consulting firms for financial services provide expert guidance in selecting and implementing RegTech solutions, ensuring businesses remain ahead of regulatory changes.

- DeFi (Decentralized Finance)

DeFi, or decentralized finance, offers blockchain-based services that bypass traditional banking. Yet, this disruption brings complexity—regulations, security, and scalability. Implementing AI in FinTech through technology consulting is crucial for overcoming these challenges. AI-driven consulting firms help businesses unlock DeFi’s full potential while maintaining compliance and security.

The future of FinTech is dynamic, and businesses must keep pace. Emerging FinTech trends in technology consulting show that AI, blockchain, and compliance automation will shape the industry. Top consulting firms for financial technology solutions will be key players in this transformation, guiding businesses toward smarter strategies. Whether it’s FinTech software development consulting services or AI-powered solutions, expert consulting is essential for staying ahead in the ever-evolving financial landscape.

Empowering FinTech Ventures through Expert Technology Consulting Services

A technology consulting company assists financial sector enterprises in devising a strategic roadmap. This involves meticulously assessing business goals and in-depth analysis of prevailing market trends. By harmonizing technology solutions with these crucial aspects, consulting firms ensure that the FinTech venture is poised for sustainable growth. This strategic alignment provides a clear trajectory for development and establishes a framework for ongoing evaluation and well-informed decision-making.

Selecting the right technology stack is critical for any FinTech startup, and technology consulting services excel in providing expert guidance in this world. Armed with comprehensive knowledge of the latest technologies, they assess how each component integrates into the FinTech ecosystem. Working closely with startups, they consider scalability, security, and long-term viability factors. The choice of a technology stack that is both scalable and secure forms the bedrock for the success of the FinTech application. It ensures that the technological infrastructure can evolve in tandem with the business, facilitating seamless expansion and service augmentation.

Fintech consulting companies leverage cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), and Blockchain to drive innovation within FinTech. These firms empower FinTech applications to deliver personalized and data-driven solutions by integrating AI and ML algorithms. This translates into enriched user experiences, precise financial insights, and streamlined process automation. Furthermore, including Blockchain technology ensures secure and transparent transactions, a critical feature in the financial services sector.

Consulting firms also give precedence over designing intuitive interfaces and seamless interactions to elevate customer satisfaction. Through a user-centric design approach, they guarantee that FinTech applications are functionally robust and user-friendly, furnishing an intuitive experience that fosters trust and loyalty among users.

Unlock the future of Real Estate lending with our Cutting-edge Inspection Platform – Read more now!

Conclusion

The synergy between FinTech innovations and expert technology consulting services reshapes the financial industry. By aligning strategic roadmaps, optimizing technology stacks, and harnessing cutting-edge technologies like AI and Blockchain, these collaborations drive efficiency, security, and enhanced user experiences. This transformative journey towards a digitally-driven financial landscape underscores the indispensable role of technology consulting firms such as Tntra in navigating and capitalizing on the FinTech revolution.

We leverage FinTech ideas to build living, breathing projects at Tntra. From AI, Machine Learning, Blockchain, or custom app development, we partner with enterprises to help them bring out innovative financial solutions. Additionally, we offer strategy consulting including IT transformation for companies in the digital space.

Want to join us in building the future of finance? Let’s do this! Contact us now!

1. Why is technology consulting important in FinTech?

Technology consulting helps financial institutions and startups navigate complex digital landscapes, ensuring seamless integration of innovative solutions, regulatory compliance, and competitive advantage in a rapidly evolving market.

2. How do consulting firms drive digital transformation in FinTech?

Consulting firms streamline operations, implement AI and blockchain, enhance user experience, and optimize financial processes, enabling businesses to modernize and scale efficiently.

3. How do technology advisors help FinTech startups scale?

Technology advisors provide strategic guidance, help implement scalable architectures, ensure regulatory compliance, and connect startups with the right tools and technologies to accelerate growth.