Empowering FinTech with AI: Real-Time Fraud Detection, Predictive Analytics, and Personalized Customer Experiences

Table of Contents

ToggleThe FinTech sector has emerged as a dynamic force reshaping the financial services landscape. With rapid innovation and digital transformation, a FinTech solution can drive new opportunities and efficiencies in banking, investments, payments, and lending. FinTech has already become 2% of global financial earnings and is further expected to rise by USD 1.5 trillion, nearly a quarter of global banking values.

However, this growth is accompanied by challenges such as increasing financial fraud, rising customer expectations for personalized services, and the need to comply with stringent regulations. This is where AI-Driven solutions are proving to be a game changer. With AI systems you can enable real-time detection, perform predictive analytics, and give personalized customer experience.

In this blog, we will explore how these advancements are empowering FinTech and highlight the role of solutions like Shruti A.I. by Tntra, in driving innovation in financial services. Let’s begin!

Why Do You Need to Empower FinTech?

The global financial services industry is undergoing rapid transformation, driven by digital innovation and changing customer expectations. In this section, we will talk about what we believe are the top five reasons why you need to empower your financial services with AI-powered FinTech app development services.

Here are five reasons why you should empower FinTech operations:

- Increasing Financial Fraud

- Customer Expectations for Personalization

- Regulatory Compliance

- Risk Management

- Efficiency and Scalability

1. Increasing Financial Fraud

Day by day financial frauds are becoming more sophisticated, with cybercriminals exploiting loopholes in digital systems. As per the 2024 Global Financial Crime Report, the fraud losses totaled $485.6 billion from various fraud scams. With traditional fraud detection systems, you can only do little since they lag in identifying and addressing advancing threats, leading to significant financial losses.

2. Customer Expectations for Personalization

Personalization in finance is a rising reality. About 86% of financial institutions state that personalization is a clear priority for them and their digital strategy, with 92% planning to invest further in the practice. Customers today demand personalized experiences tailored to their financial goals and behaviours. Meeting these expectations requires financial predictive analytics and intelligent FinTech solutions.

3. Regulatory Compliance

Navigating complex regulatory environments, such as anti-money laundering (AML) and know-your-customer (KYC) requirements, is essential for financial institutions. Manual compliance processes are time-consuming and error-prone. This is where stringer and more efficient FinTech technologies can help you manage compliance requirements of the region and industry.

4. Risk Management

As the market fluctuates more and competition increases, financial corporations need better tools to predict and mitigate risks, optimize investments, and enhance decision-making. This has necessitated the use of AI-powered FinTech tools. In fact, 77% of companies are already using AI in their businesses to improve risk management capabilities

5. Efficiency and Scalability

As the industry grows, traditional systems struggle to handle large volumes of data and transactions efficiently. Empowering FinTech with advanced technologies such as AI, machine learning, and more, ensures scalability and operational excellence.

Can AI Solutions Help in Empowering FinTech?

Yes, AI-Driven Solutions can help you make your FinTech solutions stronger. AI is a transformative force that addresses the core challenges faced by FinTech companies. Here’s how:

1. Real-Time Fraud Detection

The Growing Threat of Financial Fraud

In the digital age, financial fraud has grown in sophistication and frequency. Traditional fraud detection systems frequently miss changing threats because they are based on manual reviews and static guidelines. Delays in identifying fraudulent activity can result in large financial losses, harm to one’s reputation, and a decline in client confidence.

The Role of AI in Fraud Detection

The way financial institutions handle these issues is changing as a result of AI-driven fraud detection technologies. These systems examine enormous databases in real-time by utilizing machine learning and sophisticated algorithms, spotting unusual trends and irregularities suggestive of fraudulent activity.

For example, deep learning is used by contemporary fraud detection tools to evaluate device fingerprints, geolocation information, and transaction habits. Rapid fraud detection and prevention are made possible by this, guaranteeing that questionable activities are identified and stopped before they have a chance to cause harm.

Use Cases of Real-Time Fraud Detection and Prevention Solutions

- Credit Card Fraud: AI algorithms monitor transactional data to detect unauthorized activities, such as multiple high-value purchases in a short span.

- Identity Theft: Real-time fraud prevention systems assess login behaviours and alert users when anomalies are detected.

- Payment Fraud: AI-driven fraud detection tools ensure secure online transactions by identifying deviations in user behaviour.

2. Predictive Analytics: Shaping the Future of Finance

What is Predictive Analytics?

Predictive analytics for finance involves using data, statistical models, and machine learning to forecast future outcomes. It plays a pivotal role in FinTech by providing actionable insights that help institutions make informed decisions and mitigate risks.

Applications of Predictive Analytics in FinTech

Here are three innovative predictive analytics applications in FinTech:

- Loan Approvals: Predictive analytics models assess creditworthiness by analyzing customer financial histories, income patterns, and spending behaviours.

- Investment Strategies: AI identifies market trends and opportunities, enabling investors to optimize portfolios.

- Risk Mitigation: Predictive analytics for finance enables institutions to anticipate and respond to potential risks, such as loan defaults or market downturns.

Innovative Predictive Analytics Applications

FinTech companies are increasingly incorporating predictive analytics into their operations to enhance efficiency and customer satisfaction. Here are two use cases of financial predictive analytics.

- Customer Retention: Predictive models identify customers likely to churn and recommend targeted engagement strategies.

- Fraud Prediction: Integrating predictive analytics with real-time fraud detection systems enhances proactive fraud prevention efforts.

3. Personalized Customer Experiences

The Demand for Personalization in Financial Services

Amongst plethora of factors, personalization makes a huge difference in the financial services industry. Customers nowadays demand personalized experiences that align with their unique financial goals and preferences. In a financial landscape which is extremely competitive, traditional and one-size-fits-all approaches are being replaced by innovative digital transformation solutions that deliver tailored financial services.

AI-Driven Personalization

In our opinion, Artificial Intelligence solutions empower financial institutions to offer highly personalized financial services to their customers by leveraging data-driven decision-making processes. Through advanced customer segmentation and predictive analytics, banks and other finance companies can utilize FinTech software development to:

- Recommend financial products based on individual spending habits and life goals.

- Customize communication strategies to resonate with specific customer segments.

- Improve user experiences through intelligent AI chatbots and virtual assistants.

Benefits of Personalized Services

- Improved Customer Satisfaction: Custom solutions help in addressing customer pain points more effectively.

- Increased Loyalty: When you give personalized experiences to your customers, it fosters trust and long-term relationships.

- Higher Conversion Rates: You can use personalization techniques in reaching out to new and old customers regarding financial products and services. Targeted recommendations boost sales of financial products.

4. Regulatory Compliance and Risk Management

Navigating the Complex Regulatory Landscape

Financial institutions operate in a highly regulated environment. With the increase in the use of FinTech app development services, financial regulators are facing issues with balancing smart innovation with consumer data safety, financial stability and catching up with technology.

Regulatory frameworks put in place by domestic and international authorities play an important role in managing this equilibrium. While these frameworks and laws address emerging challenges, they also create a compliance challenge for the financial sector. For instance, compliance with laws such as anti-money laundering (AML) and know-your-customer (KYC), while critical, adds a cost burden on banking and financial institutions.

AI’s Role in Compliance

With AI, you can streamline compliance processes by automating routine tasks such as data verification, transaction monitoring, and reporting. Various financial institutions face pressure to comply with complex regulatory frameworks, including Anti-Money Laundering (AML) regulations, Know Your Customer (KYC) requirements and data privacy laws.

AI-powered systems reduce the manual burden of these processes by:

- KYC Automation: AI-driven tools verify customer identities cross-referencing them with global databases to identify discrepancies or fraudulent entries.

- AML Monitoring: Predictive analytics models identify patterns of money laundering activities.

- Regulatory Updates: AI solutions continuously update their frameworks to reflect changes in regulations, ensuring that financial institutions remain compliant without the need for constant manual adjustments.

Risk Assessment Optimization

AI enhances risk management by providing a comprehensive view of potential threats. Predictive analytics for finance evaluates market risks, operational risks, and credit risks, allowing institutions to take preemptive measures.

- Comprehensive Threat Identification: Your AI-driven solutions help in analyzing data from multiple sources to identify and prioritize potential risks. This approach ensures that financial institutions remain vigilant against market fluctuations, cybersecurity threats, and operational issues.

- Proactive Risk Mitigation: Predictive analytics models in FinTech can be used to assess historical trends and current data to forecast potential issues, such as loan defaults or investment reduction. By identifying these risks early, institutions can implement targeted strategies to minimize their impact.

- Enhanced Decision-Making: AI delivers actionable insights through advanced risk assessment algorithms, enabling financial institutions to make data-driven decisions. This improves resource allocation and ensures that critical risks are addressed promptly and effectively.

The Competitive Edge of AI in FinTech

The integration of AI and FinTech represents a dynamic and rapidly evolving sector, driving disruptive innovation across financial services. Organizations are increasingly leveraging advanced AI-powered solutions, developed by technology consulting services, to enhance customer experiences, implement robust fraud detection and prevention systems, forecast market trends, mitigate risks, and optimize overall operational efficiency.

The coming together of AI and FinTech shows a dynamic sector which is at the forefront of disruptive innovation in financial services. Organizations are massively leveraging these systems designed by technology consulting services to improve customer experience, fraud detection and prevention solutions, predict future market trends, avoid risks and more.

Tntra a software product engineering company, characterizes AI in FinTech as the implementation of technologies such as machine learning, natural language processing, predictive analytics, and cognitive computing to enhance financial companies. By leveraging these technologies with the expertise of a FinTech software development company, you can analyze customer data for informed decision-making, strengthen regulatory compliance, and elevate overall customer experiences.

From chatbots that handle customer enquiries to data-driven financial analytics solutions, AI has already become the backbone of next-generation FinTech companies.

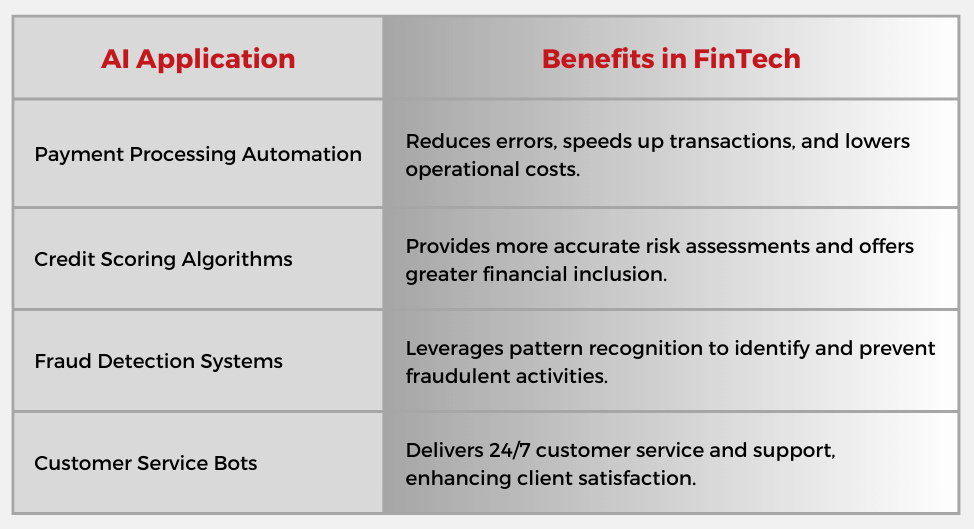

Benefits of AI in FinTech:

AI offers numerous advantages for FinTech app development services, including:

- Data-Driven Insights: AI-driven predictive analytics in financial services helps financial institutions assess risks, forecast market trends, and make informed decisions, optimizing operations and driving business growth.

- Pattern Recognition: With the help of custom AI tools developed by a software product engineering company, you can analyze market and customer data to find out trends that suggest fraudulent activity. For instance, tracking shifts in spending patterns, detecting multiple logins from various locations, and identifying money transfers to unusual destinations can automatically trigger alerts.

- Fraudulent Document Detection: AI-powered image recognition can better detect manipulated or forged documents, helping to prevent identity theft and loan fraud. For example, AI can flag inconsistencies in documents that might be invisible to the human eye.

- Efficiency and Innovation: AI brings significant advantages to FinTech app development services by enhancing efficiency and fostering innovation. Automation minimizes operational costs and errors, streamlining workflows for better productivity. Additionally, advanced technologies empower the development of innovative financial products and services, enabling businesses to stay competitive and meet evolving customer needs effectively.

Staying Ahead with Shruti A.I.

Shruti A.I. by Tntra is an innovative platform designed to enhance product development through AI-driven insights. It streamlines processes by integrating data analytics, improving design quality, and reducing time-to-market. The system leverages predictive capabilities to optimize product evolution based on market trends and consumer behaviour.

In the financial services industry, Shruti A.I. can significantly improve banking and payments by optimizing fraud detection systems. With Shruti A.I., the financial services industry can:

- Optimize fraud detection systems by analyzing transaction patterns and flagging irregularities in real-time.

- Enhance FinTech app development services by improving security, user experience, and operational efficiency.

- Streamline banking processes and payments, ensuring faster, secure transactions while maintaining compliance and mitigating risks.

Conclusion

AI is transforming the FinTech industry by offering real-time fraud detection, predictive analytics, and personalized customer experiences. With tools like Shruti A.I., financial institutions can optimize fraud detection, streamline operations, and enhance security. As a software product engineering company, leveraging AI-powered solutions helps FinTech companies stay competitive, compliant, and efficient. Embrace AI-driven innovations to boost your business and improve customer satisfaction.

Leverage Tntra’s expertise to drive innovation, improve efficiency, and secure your business in the ever-evolving financial landscape. Start your AI-driven journey with Tntra today!

1. What is the most common Financial Fraud?

Financial fraud is the loss of assets and money through unethical, illegal, and deceptive activities by fraudsters and scammers. Some of the most common types of financial fraud are:

- Identity theft

- Fake documentation

- Payment fraud

- Investment fraud

- Phishing scams

- Payroll scam

2. How will FinTech Services enhance the overall Banking Experience?

FinTech revolutionizes banking by offering personalized, 24/7 accessible services. AI-powered chatbots provide instant customer support, while mobile banking apps enable seamless transactions and account management. This enhances convenience, reduces costs, and empowers customers with greater control over their finances, leading to a more satisfying banking experience.

3. What is the most prominent challenge in Adopting FinTech?

Here are three challenges in adopting FinTech:

- Increased cyber threats

- Customer trust

- Regulatory compliance

With a software product engineering solutions company like Tntra, you can mitigate these challenges with the help of custom Fintech application development.