Unveiling the Future of AI driven FinTech

Table of Contents

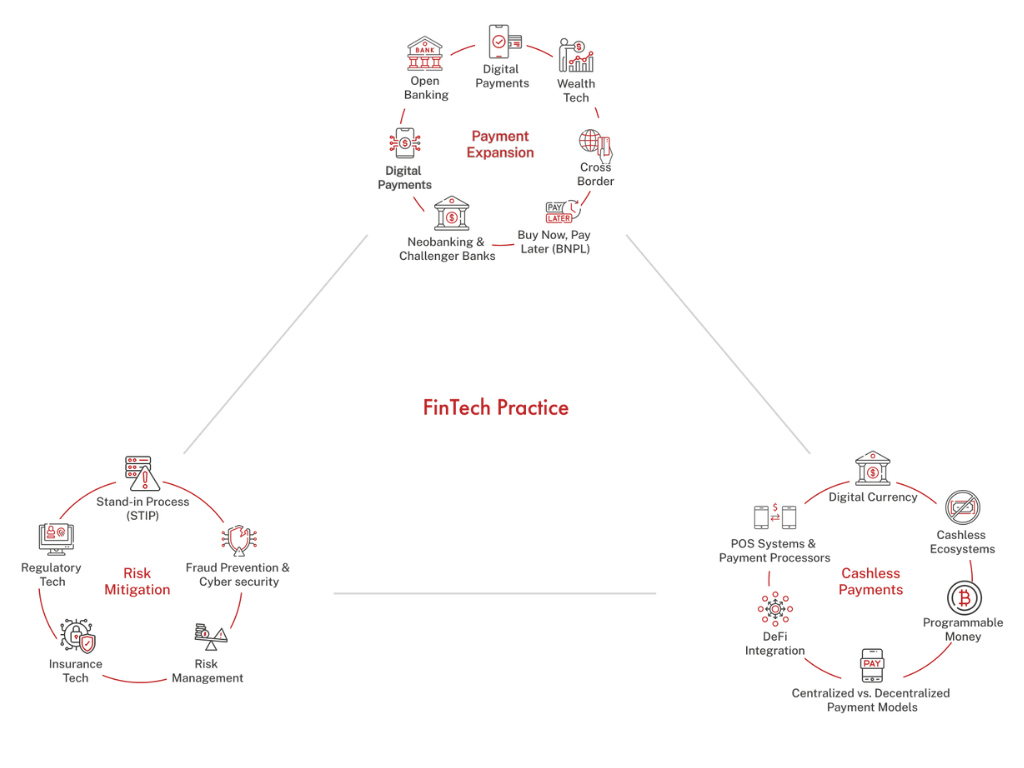

ToggleTntra’s FinTech Practice has evolved to transform the way FinTech companies operate. Comprising pf payment expansion, risk mitigation, and cashless payments, the practice focuses on building a truly futuristic fintech system. Additionally, with its proprietary AI engine, Shruti AI, Tntra empowers financial institutions to meet evolving consumer demands, redefine financial services, and navigate the complexities of the FinTech landscape, ultimately driving significant growth in an increasingly digital world.

“Tntra and its global Fintech Practice can assist financial service providers, Fintech companies and enterprises by expanding their payment abilities, mitigating overall risk and driving down fraud, and becoming a driver towards a true cashless and sustainable society, all of which are powered by Shruti AI, Tntra’s proprietary A(G)I SaaS / PaaS offering.” – Mehul Desai, Chairman and Co-Founder, Tntra

According to the World Bank Financial Inclusion Project, 27% of people worldwide are still unbanked, and another 50% are underbanked. Meeting these consumer demands presents a huge opportunity for growth. The proliferation of smartphones has led to the expansion of digital channels and the generation of significant data volumes. In addition to helping FinTechs better understand their clients, telcos in many developing nations are using this data to launch their own financial services businesses.

Recent TransUnion projections suggest that there would likely be a strong market for consumer credit, particularly for wealth management, buy now, pay later (BNPL), and embedded financing. It is imperative to consider the growing demand from customers for individualized services.

FinTech companies have the ability to utilize cutting-edge technology such as artificial intelligence (AI) and artificial generative intelligence (AGI) in order to obtain additional insights into their existing and potential clientele and offer more individualized services. However, since fraudsters are equally positioned to take advantage of cutting-edge technologies, it’s critical that they invest in strong fraud detection and prevention capabilities.

Tntra’s FinTech Practice: Important Advancements Driving Change in FinTech

At the heart of Tntra’s FinTech expertise is a dedication to harnessing technology to address complicated financial problems. This entails incorporating advanced technologies such as artificial intelligence, machine learning, blockchain, and big data analytics into financial processes. Tntra helps financial institutions make data-driven decisions, optimize operations, and improve customer engagement by utilizing these technologies.

Through its collaborative model, commitment to security, focus on user experience, and support for innovation, Tntra’s FinTech practice exemplifies a forward-thinking approach to financial technology and is well-positioned to navigate the complexities of the financial services industry and drive meaningful change.

Key Components of our FinTech Practice

Payment Expansion: Beyond Traditional Boundaries

Tntra’s payment expansion solutions empower businesses to offer a diverse range of payment options, catering to the evolving needs of their customers. By leveraging technologies like blockchain, cryptocurrency, and open banking, businesses can:

- Increase revenue streams: Offering flexible payment methods such as Buy Now, Pay Later (BNPL) and enhanced payment gateways can attract a broader customer base and drive higher sales.

- Boost conversion rates: A wider range of payment choices, including digital wallets and BNPL, can reduce cart abandonment and attract global customers, leading to increased conversions.

- Enhance customer loyalty: Providing convenient and secure payment options can improve customer satisfaction and foster long-term loyalty.

Risk Mitigation: Protecting Your Financial Fort

In today’s digital age, security is paramount. Tntra’s risk mitigation solutions help businesses safeguard their financial assets and comply with regulatory requirements. Key features include:

- Tokenization: Protecting sensitive card data through tokenization reduces the risk of data breaches and fraud.

- Fraud detection: AI-powered tools can detect and prevent fraudulent transactions, safeguarding both businesses and customers.

- Biometric authentication: Strong authentication methods like fingerprint or facial recognition enhance security and reduce unauthorized access.

- Regulatory compliance: Tntra’s solutions help businesses adhere to industry standards and avoid costly fines.

Cashless Payments: A Seamless Experience

Tntra’s cashless payment solutions offer businesses a more efficient, secure, and adaptable way to conduct transactions in the evolving digital landscape. By embracing digital payments, including mobile wallets, contactless payments, and potentially CBDCs, businesses can:

- Reduce costs: Eliminate the handling of physical cash, reducing operational expenses and minimizing the risk of loss or theft.

- Improve efficiency: Streamline transactions, enhance customer satisfaction, and boost operational efficiency with faster and more convenient digital payment options.

- Enhance security: Mitigate the risk of fraud and theft, safeguarding both businesses and customers through advanced security measures.

- Stay ahead: Position your business for the future by embracing emerging technologies like CBDCs and ensuring compatibility with evolving payment standards.

Tntra’s AI Approach in FinTech: Streamlining Financial Operations

Tntra’s AI approach to FinTech is a game-changer, enabling financial institutions to optimize operations, enhance user experiences, and improve security. By focusing on advanced technologies and using its proprietary AI engine Shruti AI, Tntra streamlines various aspects of financial services, particularly in payment systems, cybersecurity, and loan processing.

- Enhancing Payment Systems

- At the core of Tntra’s AI engine is the optimization of payment systems. The integration of AI tools into payment gateways allows for real-time currency rate predictions, significantly improving the efficiency of international transactions. For example, in the banking sector, AI algorithms analyze vast amounts of historical data and current market conditions to forecast currency fluctuations. This predictive capability ensures smoother and more efficient cross-border payments, minimizing delays and reducing costs for both banks and customers.

- Furthermore, Tntra’s AI approach with Shruti AI personalizes the transaction experience. By utilizing machine learning algorithms, financial institutions can tailor payment solutions to individual user preferences and behaviors. This personalization enhances customer satisfaction, as users receive recommendations and services that are relevant to their unique financial needs. For merchants, AI analytics integrated into mobile point-of-sale (POS) systems provide real-time insights into payment trends, helping businesses make informed decisions that improve operational efficiency.

- At the core of Tntra’s AI engine is the optimization of payment systems. The integration of AI tools into payment gateways allows for real-time currency rate predictions, significantly improving the efficiency of international transactions. For example, in the banking sector, AI algorithms analyze vast amounts of historical data and current market conditions to forecast currency fluctuations. This predictive capability ensures smoother and more efficient cross-border payments, minimizing delays and reducing costs for both banks and customers.

- Strengthening Cybersecurity

- In an age where cyber threats are increasingly sophisticated, Tntra’s AI-driven cybersecurity solutions play a crucial role in safeguarding financial transactions. Real-time threat detection becomes possible through advanced algorithms that monitor user behavior and transaction patterns. For instance, during multi-factor authentication processes, AI can detect unusual activities that may indicate potential fraud. By employing predictive analytics, these systems can identify anomalies before they escalate, offering robust security without compromising the user experience.

- Additionally, Tntra leverages AI in blockchain platforms, such as Central Bank Digital Currency (CBDC) systems. Here, AI analyzes transaction patterns, enhancing the ability to identify irregularities and potential fraudulent activities. This integration not only secures financial transactions but also allows for the provision of personalized financial services, ensuring that customers receive tailored support in a secure environment.

- In an age where cyber threats are increasingly sophisticated, Tntra’s AI-driven cybersecurity solutions play a crucial role in safeguarding financial transactions. Real-time threat detection becomes possible through advanced algorithms that monitor user behavior and transaction patterns. For instance, during multi-factor authentication processes, AI can detect unusual activities that may indicate potential fraud. By employing predictive analytics, these systems can identify anomalies before they escalate, offering robust security without compromising the user experience.

- Revolutionizing Loan Origination and Processing

- Tntra’s AI approach also significantly transforms loan origination and processing systems. By implementing AI-based predictive analytics, financial institutions can streamline the entire loan application process, reducing processing times from days to mere minutes. This efficiency is achieved through enhanced regression testing, where AI models help identify risk factors and optimize decision-making processes.

- Moreover, AI plays a pivotal role in resource allocation and project planning within financial services. By accurately estimating project timelines and resource needs, financial institutions can enhance their operational efficiency, ensuring that customer needs are met promptly and effectively. This smarter approach to loan systems not only accelerates approval processes but also enhances compliance with regulatory standards, ultimately benefiting both the lender and the borrower.

- Tntra’s AI approach also significantly transforms loan origination and processing systems. By implementing AI-based predictive analytics, financial institutions can streamline the entire loan application process, reducing processing times from days to mere minutes. This efficiency is achieved through enhanced regression testing, where AI models help identify risk factors and optimize decision-making processes.

Closing Thoughts

It is crucial to redefine Finance in light of the ongoing changes in the FinTech industry. Financial institutions need to have a comprehensive strategy that focuses on security, welcomes technology, and puts the user experience first. Tntra, a leading fintech app development company, is a game-changer in the industry, helping companies navigate this revolutionary path.

In order to develop and provide a flawless user experience, the FinTech sector needs to leverage a technological partner like Tntra that offers a safe environment to upgrade the complete infrastructure.

Learn more about Tntra’s FinTech expertise today. Schedule a call!